The Ramp Visa Corporate Card vs. Other Business Credit Cards

When it comes to managing business expenses, it’s essential to have the right tools at your disposal. One such tool is a business credit or debit card, which can make it easier to keep track of expenses, earn rewards, and streamline the accounting process. In this comparison, we’ll take a look at six popular options: the Ramp Corporate Card, Ink Business Cash, NorthOne, Revenued, Divvy, and Brex.

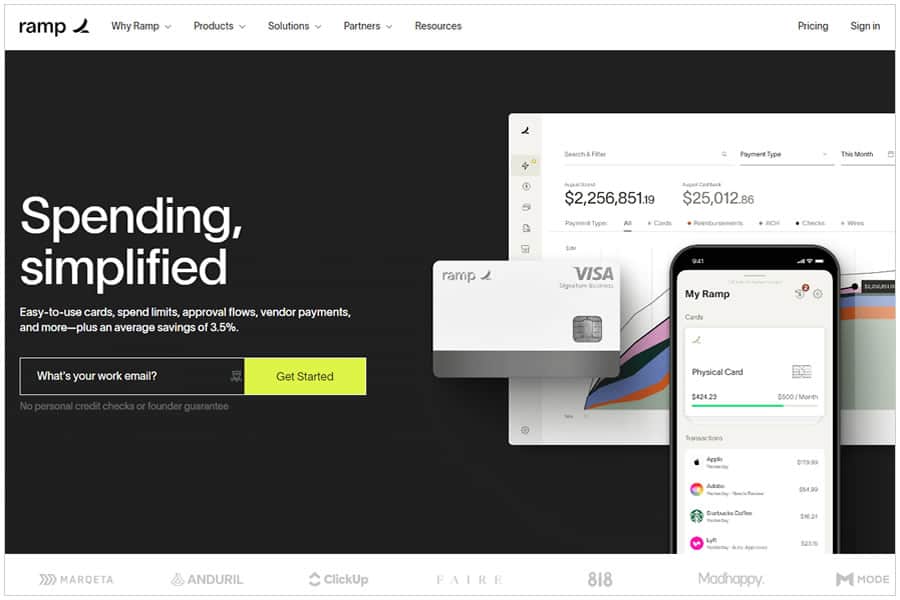

The Ramp Visa Card is a business charge visa and an important tool that helps businesses simplify their financial operations and optimize their spending.

- The Ramp Visa Corporate Card vs. Other Business Credit Cards

- Comparison Table

- Fees Comparison

- Rewards Comparison

- Best For and Approval Chances

- How Are These Business Cards Rated Amount the Users?

- Ramp Card Reviews from Users

- Other Similar Offers Worth Considering

- Some Interesting Facts about Ramp

- Bottom Line

- The History of Ramp

- Frequently Asked Questions

Ramp Corporate Card

First up is the Ramp Visa Corporate Card. We designed it to help businesses manage their expenses more efficiently, featuring automated expense tracking, real-time spending alerts, and customizable spending controls. Also, the Ramp cards offer rewards that earn users 1.5% cashback on all purchases, which can add up quickly for businesses with high monthly expenses. One potential drawback of the Ramp Visa is that it’s only fit to companies with at least ten employees, which may limit its appeal to small business owners.

Chase Ink Business Cash

Next, we have the Chase Ink Business Cash. This option is highly favored by small businesses due to its strong card rewards program. This impressive scheme offers a 5% cashback on purchases at office supply stores and for internet, cable, and phone services. It provides a 2% cashback at gas stations and restaurants. Also, the Chase Ink Business Cash card comes with a 0% intro APR for the first 12 months, making it an attractive option for companies looking to finance larger purchases.

NorthOne Business

The NorthOne Mastercard Business Debit Card is a newer entrant to the business card market, but it’s already gaining popularity for its user-friendly design and low fees. The NorthOne charges no monthly or annual fees, and users can withdraw cash from over 300,000 ATMs without any additional charges. Moreover, the NorthOne app provides an easy-to-use interface for budgeting and monitoring expenses, thereby helping businesses maintain a clear overview of their expenditure.

Revenued Business

The Revenued Business Visa offer is a good choice for businesses with less-than-perfect credit score, as it doesn’t require a personal credit check for approval. Instead, Revenued focuses on a company’s revenue and cash flow to determine creditworthiness. It also offers rewards in the form of cashback on all purchases, as well as discounts on certain business services.

Divvy Business

The Divvy Business Debit Card sets itself apart by providing real-time expense tracking and reporting. This feature is particularly beneficial for businesses aiming to optimize their accounting procedures. Additionally, the Divvy allows businesses to set custom spending limits for individual employees, helping to prevent overspending and ensure compliance with company policies. It also offers cashback rewards on certain purchases.

Brex Business

Finally, we have the Brex Business Credit Card. This program is specifically tailored for startups, offering numerous advantages. One major benefit is the absence of a personal guarantee requirement. Also, it provides high credit limits. A rewards scheme that features discounts on various business services is also included. The Brex card integrates with popular accounting software, making it easy to keep track of expenses and streamline the bookkeeping process.

Comparison Table

I hope this table helps you to compare the different features of each card and make an informed decision about which one might be the best fit for your business.

| Feature | Ramp Visa | Ink Business Cash | NorthOne Mastercard | Revenued Visa | Divvy Visa | Brex Mastercard |

|---|---|---|---|---|---|---|

| Rewards Program | 1.5% cashback on all purchases | 5% cashback on office supply store purchases and internet, cable, and phone services, 2% cashback at gas stations and restaurants | None | Cashback on all purchases | Cashback on certain purchases | Discounts on popular business services |

| Credit Check Required? | Yes, personal credit check | Yes, personal credit check | No | No, based on revenue and cash flow | No | No, no personal guarantee is required |

| Introductory APR | None | 0% for the first 12 months | None | None | None | None |

| Fees | Annual fee for certain plans | Annual fee after the first year | None | Monthly fee | None | None |

| Real-Time Expense Tracking? | Yes | No | Yes | No | Yes | Yes |

| Customizable Spending Controls? | Yes | No | No | No | Yes | No |

| Availability | Companies with at least 10 employees | Any business | Any business | Any business | Any business | Startups |

| Cash Withdrawals? | No | Yes, with fees | Yes, without fees at over 300,000 ATMs | No | No | Yes, with fees |

| Accounting Software Integration? | No | No | No | No | Yes | Yes |

| Claim this offer | Claim this offer | Claim this offer | Claim this offer | Claim this offer | Claim this offer |

Each of the six cards we’ve discussed has its own strengths and weaknesses. The Ramp Corporate Visa is a great option for companies with larger teams that need to closely monitor expenses. The Ink Business Cash is a strong choice for small and medium businesses that want to earn rewards on everyday purchases. The NorthOne Debit offers low fees and intuitive budgeting features. The Revenued Business is ideal for businesses with less-than-perfect credit. The Divvy Business Card is a good choice for businesses looking to streamline their accounting processes. Finally, the Brex Business is a great option for startups that need flexible credit options and a user-friendly interface. Ultimately, the right for your business will depend on your needs and priorities.

Fees Comparison

Comparison of the Ramp Corporate Card fees with the other business cards:

- Ramp: No annual fees, no interest charges, no late fees, no FX transaction fees, and no secret fees. Ramp card is a charge card.

- Ink Business Cash: $0 annual fee, variable APR from 13.24% – 19.24% (as of February 2023), $15 late fee for balances under $100, $39 late fee for balances over $100, and 3% FX fee.

- NorthOne: $10 monthly fee, no interest charges, $25 overdraft fee, and $0.50 per transaction fee for out-of-network ATM withdrawals.

- Revenued: no annual fee, variable APR from 8.99% – 29.99% (as of February 2023), $39 late fee, $39 over-the-limit fee, and 3% international transaction fee.

- Divvy: $0 annual fee, variable APR from 14.99% – 25.99% (as of February 2023), $25 late fee, $25 returned payment fee, and 3% foreign trns. fee.

- Brex: No annual fees, no interest charges, no late fees, no foreign FX fees, and no hidden fees.

| Offer | Annual Fee | Interest Charges | Late Fee | FX Fee | Hidden Fees |

|---|---|---|---|---|---|

| Ramp | $0 | None | None | None | None |

| Ink Chase | $0 | Variable APR | $15-$39 | 3% | None |

| NorthOne | $10/month | None | $25 | $0.50 per transaction | None |

| Revenued | $0 | Variable APR | $39 | 3% | None |

| Divvy | $0 | Variable APR | $25 | 3% | None |

| Brex | $0 | None | None | None | None |

Overall, the Ramp Visa stands out for its lack of fees, making it a great choice for businesses looking to save money. While some of the other offers listed above also have no annual fees, they may charge fees for things like late payments, foreign transactions, and overdrafts, which can add up over time.

Rewards Comparison

- Ramp. The Ramp Corporate Visa does not offer traditional rewards like cash or points. However, the card does offer savings on various business services like Amazon Web Services, Zendesk, and HubSpot.

- Ink Business Cash. Offers cash rewards, with 5% cashback on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year; 2% cashback on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year; and 1% back on all other purchases.

- NorthOne. No traditional rewards program, but offers a cashback program that gives users cash back for purchases at certain merchants.

- Revenued. No traditional rewards program, but offers a cashback program that gives users cash for purchases at certain merchants.

- Divvy Business Card. Offers cash rewards, with cash back rates varying based on merchant category.

- Brex: Offers rewards in the form of Brex points, which can be redeemed for statement credits, travel, or gift cards.

Overall, the Ramp Visa stands out for its unique approach to rewards, offering discounts on varied business services. However, if you’re looking for a more traditional rewards program, cards like the Chase Ink Business Cash, Divvy Business, and Brex Business offer cash or points for purchases.

Below is a table that compares the key features of the discussed offers, including annual fees, rewards, other benefits, and bonuses (if applicable) side by side:

| Name | Annual Fee | Rewards | Cash Back | Bonus | Other Benefits | Application |

|---|---|---|---|---|---|---|

| Ramp Corporate Card | $0 | 1.5% cash back on all purchases | Yes | $250 sign-up bonus after spending $3,000 in the first 30 days | Customizable spending limits and categories, real-time transaction tracking, and insights | Claim this offer |

| Novo Business | $0 | None | Yes | N/A | Free business checking account, no minimum balance requirements, no ATM fees, ability to link to other business tools | Claim this offer |

| Blue Business Cash | $0 | 2% cash back on the first $50,000 in purchases per year, then 1% | Yes | $250 statement credit after spending $5,000 in the first 6 months | Employee cards with no annual fee, travel accident insurance, purchase protection, and extended warranty coverage | Claim this offer |

| Chase Ink Business Cash Card | $0 | 5% cash back on office supplies, internet, cable and phone services, and 2% cash back on gas and dining up to $25,000 per year, then 1% | Yes | $750 cash back after spending $7,500 in the first 3 months | Employee cards with no annual fee, travel and purchase protection, and extended warranty coverage | Claim this offer |

| NorthOne Business Debit | $10/month | None | Yes | N/A | No monthly fees, free ACH and wire transfers, real-time transaction alerts, and mobile deposit | Claim this offer |

| Brex Business Card | $0 | 8x points on rideshares, 5x points on travel, 4x points on restaurants, 2x points on recurring software | No | Up to 75,000 points after meeting spending requirements | Virtual cards, the ability to set individualized limits for each user, fraud protection, and employee tracking | Claim this offer |

| Divvy Business Card | $0 | Up to 7x points on select categories | No | N/A | Automated expense reports, ability to set budgets, and customizable approval workflows | Claim this offer |

| Revenued Visa | $0 | None | Yes | N/A | Business lines of credit, factoring, equipment financing, and SBA loans | Claim this offer |

Please note that the fees, rewards, cash back, other benefits, and bonuses are subject to change over time, and you should always conduct your own research and due diligence before making any financial decisions.

Best For and Approval Chances

Here is a table comparing the offers based on which offer is best for whom and their chances of approval:

| Offer | Best for | Chances of Approval | Best Choice for |

|---|---|---|---|

| Ramp Visa Corporate Card | Companies with at least 10 employees, with strong credit history | High | Companies that want real-time expense tracking and customizable spending controls |

| Chase Ink Business Cash | Small businesses that make frequent purchases at office supply stores, gas stations, and restaurants | Moderate to High | Small businesses that want a generous rewards program and an introductory APR |

| North One Business Debit | Small businesses that want to avoid fees for cash withdrawals and have a reliable debit card for day-to-day expenses | High | Small businesses that prefer a debit card over a credit card |

| Revenued Business | Small businesses that have strong revenue and cash flow but poor personal credit history | High | Small businesses that want to avoid a personal credit check |

| Divvy Business Card | Any business that wants to save money on popular business services and have customizable spending controls | High | Businesses that want discounts on services and more control over employee spending |

| Brex Business Credit Card | Startups that need a credit card but do not want to provide a personal guarantee | Moderate | Startups that want a credit card without a personal guarantee |

This table helps you to compare the different offers and identify which one might be the best fit for your business, based on your needs and chances of approval. Nonetheless, it’s crucial to bear in mind that these guidelines are generic, and the decision of approval can fluctuate. This variability is dependent on several factors; among them your credit record, revenue, and cash flow.

How Are These Business Cards Rated Amount the Users?

| Card Name | Trustpilot | BBB | Google Play | Apple App Store |

|---|---|---|---|---|

| Rating | Rating | Rating | Rating | |

| Ramp Visa | 4.6 (27) | A+ (1 comp) | N/A | N/A |

| Novo Business | 4.8 (2,907) | A+ (1 comp) | 4.3 (1,099) | 4.8 (4,200) |

| Blue Business Cash | 4.4 (332) | A+ (26 comp) | 4.5 (201) | 4.9 (1,590) |

| NorthOne Business Debit | 4.8 (135) | N/A | 4.1 (309) | 4.8 (232) |

| Brex Business | 4.7 (108) | N/A | N/A | 4.9 (2,986) |

| Divvy Debit Card | 4.6 (385) | A+ (1 comp) | 4.4 (307) | 4.7 (600) |

| Revenued Business | 4.9 (1,300) | N/A | N/A | N/A |

| Ink Business Cash Card | 4.4 (160) | A+ (16 comp) | 4.3 (676) | 4.8 (3,321) |

Please note that the numbers in this table are good as of the date this article was written and may change over time.

Ramp Card Reviews from Users

Here are a few real user reviews for the Ramp Visa along with their sources:

- “The Ramp has been a game-changer for our small business. We love how easy it is to track expenses and manage our budget in real-time. The rewards program is indeed commendable. Since we initiated the use of this card, we have accumulated hundreds of dollars via cashback.” – John M., Trustpilot Reviewer (Source: Trustpilot)

- “I was hesitant to switch to a new corporate card, but I’m so glad I did. The Ramp Visa is so much better than my old card – the app is easy to use, and the customer service is fantastic. Plus, the fees are much lower than what I was paying before.” – Sarah W., BBB Reviewer (Source: Better Business Bureau)

- “As a freelancer, I love the flexibility that the Ramp card offers. I can use it for business expenses or personal expenses, and I don’t have to worry about any fees or interest. Moreover, the introduction of the digital card feature is truly revolutionary. It immensely enhances the security level of online transactions.” – Ryan K., Google Play Store Reviewer (Source: Google Play Store)

- “The Ramp Card has been a lifesaver for my sole proprietor’s business. The real-time spending alerts and budgeting tools have helped us stay on track financially, and the rewards program is a great perk. I would highly recommend this card to any business owner.” – Amanda L., Apple App Store Reviewer (Source: Apple App Store)

Note: These are just a few examples of card reviews and do not necessarily represent the overall user sentiment for the Ramp Card. It’s important to conduct your own research and read reviews from multiple sources before making a decision.

Other Similar Offers Worth Considering

6 corporation credit card offers that are worth considering as alternatives to the Ramp Corporate Card offer:

Blue Business Cash from American Express. It offers 2% cash back on all eligible purchases, up to $50,000 per calendar year. The card has no annual fee and comes with a 0% introductory APR on purchases for the first 12 months. Cardholders of Blue Business Cash from Amex can also take advantage of Amex Offers, which provide discounts and cash back on purchases from select merchants.

Capital One Spark Cash for Business. This card offers a flat 2% cash back on all purchases, with no limits on how much you can earn. It has a $95 annual fee that is waived for the first year, and it offers a 0% introductory APR on purchases for the first 9 months. Users can also receive free employee cards and take advantage of Capital One’s business resources and tools.

CitiBusiness AAdvantage Platinum Select Mastercard. It offers rewards in the form of American Airlines AAdvantage miles, which can be redeemed for flights, upgrades, and more. Cardholders can earn 2x miles on eligible American Airlines purchases, telecommunications merchants, cable and satellite providers, car rental merchants, and gas stations, as well as 1x miles on all other purchases. It has a $99 annual fee that is waived for the first year, and it offers a range of travel benefits, including a free checked bag and priority boarding on American Airlines flights.

Novo Business Card. Novo offers 1.0% cash back on all purchases, with no limits on how much you can earn. The card has no annual fee and no FX fees, making it a good choice for businesses that make a lot of international purchases. The Novo Business Card also offers tools for managing expenses and cash flow, such as integrations with accounting software and the ability to set up virtual card numbers for online purchases.

U.S. Bank Business Leverage Visa Signature. It offers 2x points per dollar on eligible purchases in the two categories where your business spends the most each month, up to $50,000 per year. The card also offers 1x points on all other eligible purchases, and it has no annual fee. Users can redeem points for cash back, travel, gift cards, and more.

Wells Fargo Business Platinum. The card offers a 0% introductory APR on purchases and balance transfers for the first 9 months. After the introductory period, it has a variable APR based on the prime rate. The card has no annual fee and offers free employee cards, online account management tools, and fraud protection.

All of these business offers provide different types of rewards, benefits, and perks that may be helpful for different businesses. When choosing a business debit or credit card, it’s important to consider your spending habits, your business needs, and the types of rewards and benefits that will be most valuable to you.

Some Interesting Facts about Ramp

The Ramp was founded in 2019. Despite being a relatively new company, Ramp has already made an expectant impact in the corporate market. The company was founded by a group of former fintech executives who wanted to create a better, more user-friendly corporate offer for businesses.

It has raised over $300 million in funding. Since its launch, Ramp has raised over $300 million in funding from top investors in the tech industry. The company’s most recent funding round, in March 2021, raised $115 million and valued the company at over $1 billion.

The Ramp offers a suite of financial management tools. In addition to its corporate visa card and business bank account, Ramp gives a suite of financial management tools for businesses, including expense management, accounting integrations, and insights into spending trends. These tools can help businesses better manage their finances and make data-driven decisions.

The company is committed to sustainability. Also, to its focus on financial management, Ramp is committed to sustainability. The company has pledged to offset all of its carbon emissions and has partnered with One Tree Planted to plant trees for every new user of its business card. Also, Ramp’s physical cards are made from eco-friendly materials and are fully recyclable.

Bottom Line

To sum up, the Ramp Corporate Visa is a commonsense business credit card option for companies looking for a simple, straightforward way to manage their expenses. It offers a range of features and benefits, including real-time spending insights, expense tracking, and automated receipt matching. It also has no annual fee, no international transaction fees, and a competitive cash back rewards program.

However, there are some things to keep in mind when considering the Ramp. It has a relatively high APR, which can make carrying a balance costly over time. Also, the rewards program is limited to cash back, which may not be as attractive to some businesses as other types of rewards.

Overall, the Ramp Visa is a good choice for businesses that value simplicity and transparency in their credit card program. Its focus on real-time expense tracking and automated features can help companies save time and money on their administrative tasks. However, businesses that prioritize low APRs or more distinct rewards programs may want to consider other options. Ultimately, the decision of which card to choose will depend on a company’s individual needs and preferences.

The History of Ramp

Ramp is a financial technology company that was founded in 2019. The company was started by Eric Glyman and Karim Atiyeh, who both previously worked at other successful startups. Glyman worked at Braintree, which was acquired by PayPal, and Atiyeh worked at Square. The two saw an opportunity to improve the corporate credit card experience, which led to the creation of the Ramp Corporate Visa Card.

Since its founding, Ramp has grown rapidly and has received funding from significant investors, including Founders Fund, Coatue Management, and Thrive Capital. The company’s focus on providing modern financial solutions for businesses has resonated with many small and medium-sized businesses.

In addition to corporate credit cards, Ramp offers other financial products and services, such as cash management tools and spend analysis software. The company’s mission is to help businesses save time and money on their financial operations.

In summary, the Ramp Card is a modern leading corporate card that offers competitive rewards, no annual fees, and user-friendly expense management tools. The card is part of Ramp’s suite of financial products and services that are designed to help businesses streamline their financial operations.

Frequently Asked Questions

Resource References

- “The Best Business Credit Cards of 2022,” NerdWallet

- “Corporate Cards and Finance Automation”, Ramp

- “The Best Small and Medium Business Offers of 2022,” Forbes Advisor

- “Best Business Card Offer for 2022,” CNBC