Revenued Business Card Visa®

Instant approval, No monthly or annual fees, plus get $500 bonus rewards

Updated: Feb 09, 2023

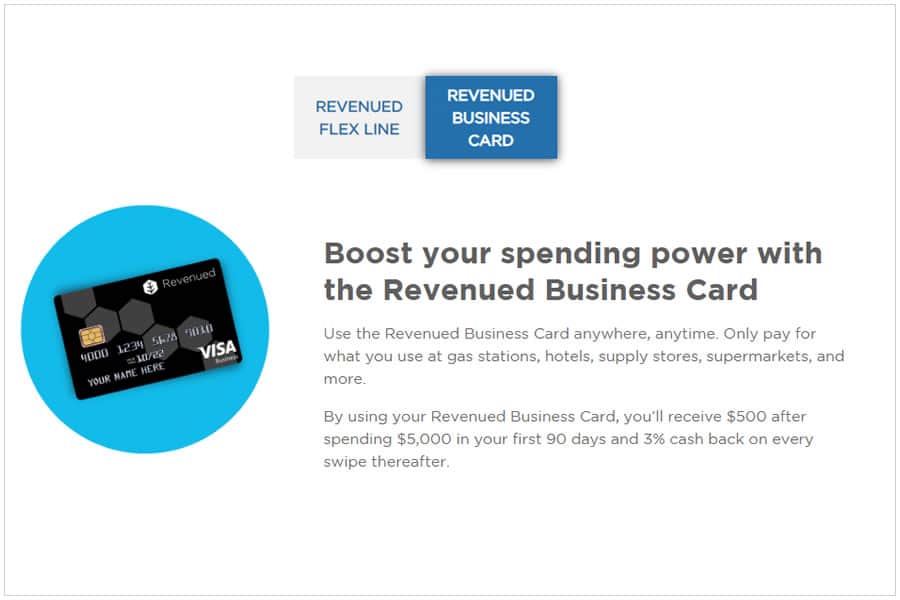

The Revenued Business Visa Card + Flex Line financing program is designed for businesses with revenue-based approval, regardless of credit details. Unlike other financing solutions, USA-based businesses can apply for Revenued without charge and incur no monthly or annual fees when using the Card or Flex Line. The application process is online and approvals are within 24hours.

ANNUAL FEE

$0

ONGOING APR

0% Fixed

INTRO APR

N/A

at Revenued Secured website

Apply NowIntroductory APR

N/A

Intro APR Period

N/A

Recommended Credit Score

Accepts All

Key Features

- Business Card and Flex Line bundled into one

- $500 back after $5,000 spending in the first 3 months

- 3% cashback on every purchase

- Flex line: 3% on the first 6 months of opening an account

- Approvals are based on revenue, not bureau score

- No minimal FICO is required

- No annual fees and no monthly fees

- Revenued Business Card is issued by Sutton Bank and powered by Marqeta

Our Take

The Revenued Business Visa Card by Sutton Bank caters to business owners, making running a business and keeping your credit score1 high seem like an easy task. Many business owners use this Visa card to make purchases that will help their businesses grow. You can apply for this card even if your credit score is not at its best or you have no credit history.

Revenued Business Card is Best for

- USA based business owners

- Business professionals with a poor credit score

- Those who don’t want additional fees

- Business owners with no credit history

What Are Revenued Business Advantages

The Revenued Business Visa card offers many benefits to those who are just starting their business or want to grow their existing company. It caters to business owners and has several advantages.

Cashback rewards

Many business cards offer cashback2 rewards, but this one might be ahead of its competitors. Once you open your account and start using the card, you are eligible for up to 3% cashback rewards on all the purchases you make with your card.

Bonus rewards

Moreover, you will get $500 back on $5,000 spent within the first three months of opening an account.

No credit score requirements

If you want to start taking care of your finances as a business owner but don’t know where to go with your low credit score, this card might be perfect. It enables almost anyone to apply and enjoy its benefits. You can get approval even with no credit history because it’s a debit card, not a credit card. The issuer doesn’t pull a hard credit check but considers your revenue.

No maintenance fees

This prepaid card doesn’t have any fees for maintaining and using it. You can open an account for free and freely spend the money without worrying about additional charges. There are no annual or monthly fees that you have to pay to use your card.

Digital banking

In the world of technology, using your card in digital form can come in handy. Using the digital baking features this card offers gives you an insight into your balance and spending and a calendar that contains data about your daily, weekly, and monthly spending.

Flex Line

This card has the option to access the Flex Line feature. With this feature, you can quickly transfer your assets and deposit them in cash. You can get a flexible spending limit and determine how much money you want to use. You will pay only for what you use, not a penny more.

Are There Any Disadvantages?

Although there are many advantages to using this prepaid card, there are still some things that are not quite the best. However, there are many more advantages than disadvantages to using this card. Let’s look at some potential drawbacks to consider before applying.

Spending limit

There is a limit to how much money you can spend daily, monthly, and yearly. For example, you can spend up to $10,000 daily and the same amount on a single purchase, but you can spend a maximum of $50,000 monthly. If you are a business owner with more expenditures, you should consider using another business card.

Revenue-based approval

Many people think that the Revenued Business Card helps them rapidly build a credit score. Although it may help establish or improve your credit score, it is not its primary use.

This card is a prepaid debit card; you can deposit as much money as you want, but that is the money you have earned – your revenue3. You won’t be borrowing money from the bank. You will have to use the Flex Line feature to build your credit score.

No intro APR

This card may not be for you if you’re looking for an introductory APR on balance transfers or purchases. It doesn’t have this promotional feature to help you save on interest.

It might be a deal-breaker if you’re counting on a low interest rate to make a significant purchase to start your business or grow your established company.

What Makes Revenued Business Card Different?

No credit requirements

Many business cards available on the market can help you build your credit score and your business from the ground up. However, this card’s issuer had something else in mind. Their policy states that you don’t have to have a good credit score to be able to use your card for business purposes. It is one of the things that makes this card different from other business cards on the market.

High cash back rewards

Another feature making it stand out is the cashback. Many other cards offer cashback rewards, but few of them give back 3% cash on every purchase you make. Other cards usually have limitations regarding merchants that will give you cashback, but you can spend your money anywhere with this card and still get some percentage back.

Can improve credit

The Revenued Business card might not solely be a card that will increase your credit score; you need to use the Flex Line feature to build your credit. However, this card is an excellent option for those who want to make business progress but don’t know where to start.

What Are the Requirements to Apply?

- Be in the US in operation for 6 months or more (No start-ups)

- Have a separate business bank account

- No more than 3 negative balance days each month

- $10,000 or more in deposit volume each month

- Not be a sole proprietorship.

- Not be a financial services company or law firm

Bottom Line

The Revenued Business Visa is one of the best business cards. You don’t need a good credit score to apply and use it to grow your business. Moreover, there are many benefits to this card that we have mentioned above. The most crucial part is that you don’t have to pay a fee for using the card. You can deposit your money and spend it freely without the pressure of paying a fee for every purchase or monthly maintenance. Moreover, you can earn back some money with the cashback feature.

Overall, using the Revenued Business Card is an excellent way to keep track of your business’s finances and do it without a fee. We recommend it to both startups and established companies.

Frequently Asked Questions

Reference Index

- What is Credit Score? CBS News

- What is Cashback? CFI

- What is Revenued? Investopedia

| Issuer: | Sutton Bank |

|---|---|

| Network: | VISA® |

| Category: | Business (Regular) |

| Review: | Full Card Review |

| Best Used For: |

|

| Rewards: | Yes |

| Reward Types: |

|

| Reward Units: | Cash |

| Regular APR: | 0% |

|---|---|

| Regular APR Type: | Fixed |

| Annual Fee: | $0 |

| Balance Transfer: | Yes |

| Grace Period: | None |

| Late Payment Fee: | $0 |

| Other Fees: |

|

Revenued Business Card Visa® Alternatives

Revenued Business Card Visa® |

| APPLY NOW |

|

Annual Fee $0 |

|

Regular APR 0% |

|

Intro APR N/A |

|

Rec. Credit Score Accepts All |

Additional Information & Comments

Available across the United States, except Michigan.

Revenued Business Card Visa®

Reviews - (1 User Reviews)Exceeded expectations

Save to Compare