6 Upgrade Credit Cards Comparison (Upgrade Bitcoin vs Triple Cash vs Cash Rewards vs Classic vs OneCard vs Life Rewards)

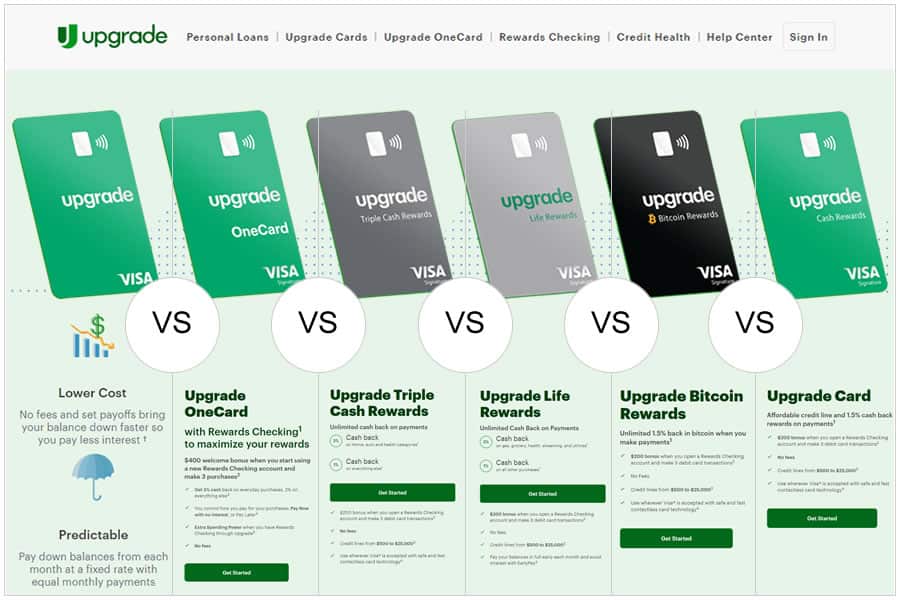

If you’re searching for credit cards that offer a unique combination of benefits, then Upgrade may be the perfect fit for you. With six different Visa credit cards, each with their own set of benefits and rewards, Upgrade provides a range of options that cater to your specific financial needs. Whether you’re looking to improve your credit score without any fees, earn cash back on specific purchases, or receive rewards in bitcoin, Upgrade’s credit cards provide the convenience of a credit card and the predictability and low costs of a personal loan.

What sets Upgrade apart is that each of their credit cards offers a range of benefits and rewards, making it easy to choose the right one for your financial goals. With no fees, affordable monthly payments, equal monthly payments, and set payoffs, Upgrade credit cards provide flexibility and convenience whether you’re shopping online or in-store.

Let’s take a closer look at Upgrade’s credit cards so that you can make an informed decision based on your needs.

- Upgrade Bitcoin Card – the perfect choice for cryptocurrency enthusiasts who want to earn unlimited bitcoin rewards while using their credit card both nationally and internationally.

- Upgrade Cash Rewards Card – ideal for anyone who wants to transfer their balances while earning rewards on every purchase without paying any annual fees.

- Classic Upgrade Card – best for those who are not interested in earning rewards but still want a card with no annual fee and no international transaction fees. It’s perfect for balance transfers or to use alongside the Upgrade Personal Loan.

- Upgrade Triple Cash Card – designed for those who plan to spend primarily in the Auto, Health, and Home categories, allowing them to earn higher cash back rewards and access the Upgrade Loan directly.

- 6 Upgrade Credit Cards Comparison (Upgrade Bitcoin vs Triple Cash vs Cash Rewards vs Classic vs OneCard vs Life Rewards)

- Upgrade Cards Comparison Table

- 6 Upgrade Credit Cards

- Are There Any Differences?

- What Are the Similarities?

- Upgrade Credit Cards – Benefits, Pros, and Cons

- Upgrade Cards Competition and Alternatives

- Additional Upgrade Products

- Bottom Line

- Frequently Asked Questions

Upgrade Cards Comparison Table

| Cash Rewards | OneCard | Triple Cash Rewards | Life Rewards | Bitcoin Rewards | Upgrade Card | |

|---|---|---|---|---|---|---|

| Key Feature | Cash rewards | Pay now or pay later | Cash rewards | Cash rewards | Cryptocurrency reward | Improving Credit |

| Annual Fee | $0 | $0 | $0 | $0 | $0 | $0 |

| Regular APR | 8.99% -29.99% | 8.99% -29.99% | 8.99% -29.99% | 8.99% -29.99% | 8.99% -29.99% | 8.99% -29.99% |

| Cash Advance | $0 | $0 | $0 | $0 | $0 | $0 |

| Late Fee | $0 | $0 | $0 | $0 | $0 | $0 |

| Returned Payment | $0 | $0 | $0 | $0 | $0 | $0 |

| Foreign Trans Fee | $0 | $0 | $0 | $0 | $0 | $0 |

| Welcome Bonus | $200 Bonus1 | $400 Bonus3 | $200 Bonus1 | $200 Bonus1 | $200 Bonus1 | – |

| Rewards | Unlimited 1.5% cash back | Unlimited 2% – 3% cash back | Unlimited 1% – 3% cash back | Unlimited 3% cash back | Unlimited 1.5% back | No rewards |

| Top Reward Categories | All transactions | Everyday purchases | Home, Auto, and Health | Gas, Grocery, Health, Streaming, and Utilities | Bitcoins | – |

| Extra Rewards | 10% extra cash back when Shopping powered by Dosh | 10% extra cash back when Shopping powered by Dosh | 10% extra cash back when Shopping powered by Dosh | 10% extra cash back when Shopping powered by Dosh | 10% extra cash back when Shopping powered by Dosh | 10% extra cash back when Shopping powered by Dosh |

| Credit Limit | $500 to $25,000* | $500 to $25,000* | $500 to $25,000* | $500 to $25,000* | $500 to $25,000* | $500 to $25,000* |

| EarlyPay | Yes | Yes | Yes | Yes | Yes | Yes |

| Fraud Liability | Yes | Yes | Yes | Yes | Yes | Yes |

| Contactless | Yes | Yes | Yes | Yes | Yes | Yes |

| Review | Upgrade Rewards Card Review | Upgrade Bitcoin Comparison | ||||

| Learn More | More info | More info | More info | More info | More info | More info |

| Application | Claim this offer | Claim this offer | Claim this offer | Claim this offer | Claim this offer | Claim this offer |

6 Upgrade Credit Cards

Upgrade offers a comprehensive suite of financial products that includes 6 unsecured Visa credit cards and 1 personal loan option.

- Cash Rewards card provides unlimited 1.5% cashback on all payments with no fees and requires an average to excellent credit score.

- OneCard is a unique option that offers a $400 welcome bonus when cardholders open a new Rewards Checking Account and make three purchases.

- Triple Cash Rewards card offers unlimited 3% cashback on health, auto, and home purchases, and 1% cashback on all other purchases, with no fees and an average to excellent credit requirement.

- Life Rewards card provides unlimited 3% cashback on purchases related to gas, groceries, health, streaming, and utilities.

- Bitcoin Rewards. For those interested in cryptocurrency, the Bitcoin Rewards card offers unlimited 1.5% cashback in bitcoin, with no fees except for the bitcoin exchange fee and an average to excellent credit requirement.

- Classic Card offers a credit line ranging from $500 to $25,000 with no fees, making it an excellent option for improving credit, but it doesn’t offer any rewards.

Upgrade credit cards are issued by Cross River Bank and can be used like regular Visa credit cards. Any unpaid balances are automatically converted into installment plans with an affordable interest rate, allowing cardholders to make equal monthly payments over a set period, just like a personal loan. Additionally, each card has a credit line that can be borrowed against, with funds transferred to the cardholder’s bank accounts upon request. This feature makes Upgrade credit cards a flexible solution for managing financial needs.

Are There Any Differences?

If you’re considering an Upgrade credit card, it’s important to understand the differences between each option. Upgrade offers 4 basic credit card options: Upgrade Cash Rewards, Upgrade Triple Cash Rewards, Upgrade Bitcoin Rewards, and Classic Upgrade Card. The primary difference between each card is the rewards program.

Upgrade Visa Cash Rewards offers a flat rate of 1.5% cashback on all purchases. Upgrade Triple Cash Rewards Visa offers a tiered cashback structure, allowing cardholders to earn up to 3% cashback on select purchases related to health, auto, and home, such as gym memberships, home improvement supplies, and beauty services.

The Upgrade Bitcoin Rewards Card is a unique option that allows cardholders to earn 1.5% back in bitcoin. Each time you make a payment, bitcoins are automatically purchased and held in a crypto wallet provided by NYDIG. While the bitcoins cannot be transferred to another wallet, they can be traded for a statement credit after a 90-day holding period. However, selling bitcoins will incur a transaction fee. (See: Cryptocurrency rewards cards)

Finally, the Classic Upgrade Card doesn’t offer any rewards. Instead, it provides cardholders with a personal line of credit to help them improve their credit scores.

By understanding the differences between these Upgrade credit cards, you can choose the one that’s right for your financial needs and goals.

What Are the Similarities?

While Upgrade offers multiple credit cards with different rewards programs, there are several similarities shared among all of them. For example, all Upgrade cards have no transaction fees and offer the same range of interest rates and credit limits. However, qualifying for each card may depend on factors such as credit score and usage history.

Another similarity among Upgrade cards is their international usability with no foreign transaction fees. However, it’s worth noting that Upgrade credit cards cannot be used at ATMs for cash advances, and balance transfers from other credit cards are not permitted.

All Upgrade cards operate on a payment-based rewards system, where cardholders earn rewards by making payments toward their balance. The only exception is the Upgrade Visa card for improving credit, which doesn’t offer a rewards program but can help improve credit scores.

Lastly, all Upgrade cards, including Upgrade Triple and Cash Rewards, have the same credit score recommendations of Excellent, Good, Fair, or Average. By understanding these shared features and limitations, you can select the Upgrade card that best fits your financial needs

Upgrade Credit Cards – Benefits, Pros, and Cons

| Advantages | Disadvantages |

|---|---|

| – No fees to acquire and use the cards; – An excellent alternative to balance transfer offers; – An option to choose cash back or improving credit; – Hybrid credit card/personal loan financial tool; – No annual fee, activation, or maintenance; – No foreign transaction fees; – Qualify with average credits; – High rewards rate; – Reports to all three major credit bureaus | – Limited availability; – Some benefits of traditional credit cards are lacking (0% intro APR); – No option to save up your cash back; – Upgrade cards are not available to residents of Washington, D.C. |

Other Upgrade Cards Benefits

The Upgrade Card offers a range of benefits to customers with fair, good, and excellent credit scores (FICO scores 600 and up) including:

- Cash back rewards. Cardholders earn cash back on all purchases, providing a simple way to save money on everyday expenses. Additionally, using the Upgrade Card responsibly can help improve credit scores over time.

- Affordable payments. The Upgrade Card offers affordable monthly payments with no fees, making it an attractive option for customers looking to manage their finances responsibly.

- No hard pull on credit reports. Unlike some other credit cards, the Upgrade Card does not require a hard pull on credit reports, making it a great option for those who want to avoid negatively impacting their credit scores.

- Standard Visa benefits. The Upgrade Card comes with all the standard benefits of a Visa credit card, including fraud protection, zero liability for unauthorized purchases, and more.

- Predictable payments. For those who need to borrow money, Upgrade also offers personal loans with predictable payments and lower costs than many other lenders.

- Top security features. Upgrade takes security seriously, offering top-notch security features including virtual card numbers, encryption, and 24/7 monitoring for suspicious activity.

Overall, the Upgrade Card is a versatile financial tool that offers a range of benefits to customers looking to manage their finances responsibly and save money on everyday expenses.

Upgrade Cards Competition and Alternatives

| Card Name | Issuer | Annual Fee | Bonus | Rewards | Application |

|---|---|---|---|---|---|

| BlockFi Bitcoin Rewards | Evolve Bank & Trust | $0 | 3.5% back in bitcoins for 3 months | Unlimited 1.5% bitcoin rewards | Claim this offer |

| Aspiration Zero Mastercard | Beneficial State Bank | $60 | Get $300 for saving the planet | Up to 5% cash back | Claim this offer |

| Gemini Credit Card | WebBank | $0 | Fast pre-qualification, Luxury Card | Up to 3% crypto back | Claim this offer |

| Fortiva Mastercard | Bank of Missouri | See terms | Fast pre-qualification, Builds Credit | Up to 3% cash back | Claim this offer |

| Chase Sapphire Preferred | Chase Bank | $95 | 60,000 bonus points | 2% to 5% Unlimited Reward points | Claim this offer |

| Owners Rewards Card by M1 | Celtic Bank | See terms | 1 year free M1 Plus Membership | Up to $10% cash back | Claim this offer |

| Stilt Debit Mastercard | Other Issuers | $0 | No SSN is required | – | Claim this offer |

Additional Upgrade Products

As you navigate your financial journey, it’s essential to explore various avenues that can maximize your potential. In addition to what you’ve already discovered about Upgrade, there are more opportunities that await. These offerings, each with unique features and benefits, aim to empower you further in managing your personal finance. Whether you’re focused on boosting your savings, optimizing your everyday spending, or addressing larger financial needs, these additional Upgrade products can offer the solutions you’re seeking. Let’s look into into these opportunities to uncover more ways for you to flourish financially.

Upgrade Premier Savings – Exceptional Earnings with Zero Fees

Upgrade Premier Savings offers a tremendous opportunity for growth with an impressive 4.81% APY on balances of $1000 or more, one of the highest rates in the nation. This exceptional rate ensures you reach your financial goals faster. But it’s not just about growth; this account also ensures you save more by eliminating common banking costs. With no monthly account fees or transfer fees, every dollar you deposit remains intact and continues to grow. What’s more, you get secure, 24/7 mobile access to your account, allowing you to manage your savings conveniently and effortlessly. Premier Savings is designed to fit your ambitions and your lifestyle.

Upgrade Rewards Checking Plus – Amplify Your Rewards and Savings

With Upgrade Rewards Checking Plus, you’re not just spending, you’re earning. This innovative account offers up to 2% cash back on common everyday expenses, such as convenience and drug stores, gas stations, monthly subscriptions, restaurants, and even utilities. For all other charges, you enjoy unlimited 1% cash back, given that you have direct deposits. Add to this a feature where you can add Performance Savings to earn up to 4.81% APY, maximizing your financial growth. You’ll also enjoy getting paid up to 2 days early and the freedom from monthly fees. It’s more than just a checking account; it’s a financial tool that rewards your everyday spending and enhances your savings.

Upgrade Personal Loans – Build Your Future with Simplicity and Affordability

Upgrade Personal Loans offer a straightforward and practical solution to finance your goals. Whether it’s refinancing credit cards, consolidating debt, making home improvements, or making a major purchase, these personal loans can cater to a wide array of needs. With loan amounts of up to $50,000 and low fixed rates, these loans are both versatile and affordable. The affordable monthly payments and absence of prepayment fees further enhance its appeal, making it easy for borrowers to manage their debt. Moreover, as an incentive, you can get $200 when you open a Rewards Checking account and make 3 debit card transactions. With Upgrade Personal Loan4, you can step towards building a secure and financially sound future.

Upgrade Auto Refinancing – Maximize Your Savings

Upgrade Auto Refinancing – offers an easy, quick, and efficient way to refinance your car loan, potentially saving you a significant amount of money over time. By using this service, you can unlock lower interest rates and affordable monthly payments that could substantially reduce the financial stress of owning a vehicle. The reliable support provided by Upgrade Auto Refinancing can assist you every step of the way, making the refinancing process as seamless as possible. The best part is there’s absolutely no prepayment penalty, so you have the freedom to pay off your loan whenever you want without any additional charges. Remember, to be eligible for their service, your car needs to meet certain requirements and your current loan must have an outstanding balance greater than $5,000 with at least three monthly payments already made. Notably, Upgrade Auto Refinancing5 is currently not available for RVs, motorcycles, commercial vehicles, or salvaged vehicles. So why wait? Check your rate online today, confirm your details, and drive off with savings.

Bottom Line

Choosing the right financial product for your needs is a deeply personal decision, contingent on your specific goals and spending habits. If your primary objective is to build your credit, the Upgrade Card emerges as a strong contender. Conversely, if you’re planning significant expenditures related to health, auto, or home, the Upgrade Triple Cash Rewards card could be your perfect match.

Cryptocurrency enthusiasts will find the Upgrade Bitcoin Rewards Visa enticing, as it offers an innovative way to earn rewards in bitcoin. If your focus is primarily on earning cash rewards from your purchases, the Upgrade Cash Rewards card may be the ideal choice for you.

Apart from these credit card options, Upgrade also offers other products like high-yield savings accounts, cash back checking accounts, and personal loans, each uniquely tailored to help you optimize your financial situation. Whether you’re looking to augment your savings, earn on everyday expenses, or secure affordable credit, there’s an Upgrade product waiting to meet your needs.

It’s crucial to deliberate on your spending habits and financial goals before selecting an Upgrade product. By doing so, you can make an informed decision, ensuring your choice aligns seamlessly with your financial objectives and aids you in achieving your personal financial milestones.+

Frequently Asked Questions

Upgrade Personal loans Disclaimer

4Personal loans made through Upgrade feature Annual Percentage Rates (APRs) of 8.49%-35.99%. All personal loans have a 1.85% to 9.99% origination fee, which is deducted from the loan proceeds. The lowest rates require Autopay and paying off a portion of existing debt directly. Loans feature repayment terms of 24 to 84 months. For example, if you receive a $10,000 loan with a 36-month term and a 17.59% APR (which includes a 13.94% yearly interest rate and a 5% one-time origination fee), you would receive $9,500 in your account and would have a required monthly payment of $341.48. Over the life of the loan, your payments would total $12,293.46. The APR on your loan may be higher or lower and your loan offers may not have multiple term lengths available. The actual rate depends on credit score, credit usage history, loan term, and other factors. Late payments or subsequent charges and fees may increase the cost of your fixed-rate loan. There is no fee or penalty for repaying a loan early. Personal loans issued by Upgrade’s bank partners. Information on Upgrade’s bank partners can be found at https://www.upgrade.com/bank-partners/.

5Auto refinance loans through Upgrade feature Annual Percentage Rates (APRs) of 5.24%-17.94%. The lowest rates require Autopay. The APR on your loan may be higher or lower and your loan offers may not have multiple term lengths available. The actual rate depends on credit score, credit usage history, loan term, and other factors. Late payments or subsequent charges and fees may increase the cost of your fixed-rate loan. There is no fee or penalty for repaying a loan early. Eligible vehicles must be 10 years old or newer and have less than 130,000 miles (or less than 150,000 for trucks).

**Accept your loan offer and your funds will be sent to your bank or designated account within one (1) business day of clearing necessary verifications. Availability of the funds is dependent on how quickly your bank processes the transaction. From the time of approval, funds sent directly to you should be available within one (1) business day. Funds sent directly to pay off your creditors may take up to 2 weeks to clear, depending on the creditor.