Understanding and optimizing your credit score can be a challenging task in the vast financial landscape. This score, which is crucial to your financial health, influences a variety of aspects from loan approvals to interest rates. Large banks and insurance companies use statistical models, with many adopting the widely recognized FICO model, to generate this score. This comprehensive guide will clarify what a credit score is, how to repair a damaged one, strategies to enhance it, and methods to protect it. Offering more than 25 practical tips and insights, this guide is here to equip you with the knowledge to enhance and protect your financial standing, ensuring you have the upper hand in your financial journey.

What Does the Credit Score Mean?

An individual’s credit score is calculated using a statistical model. The large banks and insurance companies usually have their own ‘in-house’ calculator. In common with the majority of businesses they also use FICO models. These were created by the Fair Isaak Corporation, founded in 1956. They are probably the best-known and most used credit-scoring formulae in the world. Fair Isaak offers specific scoring models for the US, Canada, and South America and offers ‘Global FICO’ for many other countries.

In order to decide whether an applicant qualifies for the credit, lenders check the individual’s credit report. Based on their previous credit history and other factors, the lender decides on the likelihood of the person concerned being able to meet any credit commitments in the future. All lenders have access to credit reports. (Read: What is a Credit Score?)

Know Your Credit Score

You can have a free copy of your credit report from one of the three main US reporting companies, TransUnion, Equifax or Experian. You can get it free every 12 months here.

However, a detailed report, which shows and calculates credit scores will cost a small fee. You can also register with a monitoring company online. Get your free credit report online.

RELATED: How to Cancel Credit Monitoring

Credit Score Formula

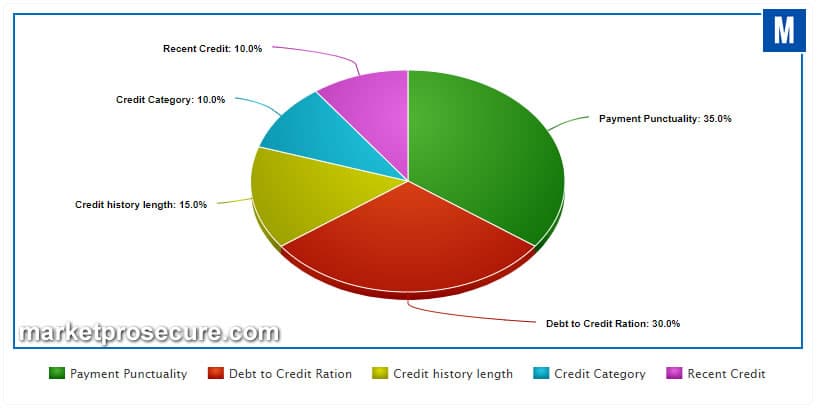

The exact formula for calculating a credit score is not revealed but the following elements do apply. The percentages are approximate.

- 35% – Payment punctuality

- 30% – Ratio between current debt and total available credit

- 15% – Credit history length

- 10% – Credits category (i.e. type of credit agreements entered into)

- 10% – Recent credits

The percentages given above provide a vague idea of what factors are influencing your credit score. For instance, the 10% value given for types of credit taken in past, does not tell you what mix of credit in the past is going to be most beneficial to you. Foreclosures, judgments, and many other factors can also influence your score.

All credit-scoring models are subject to Federal regulations. The Equal Opportunity Act prepared by the Federal Reserve Board prohibits any form of scoring which considers factors such as race, religion, color, sex or marital status. In addition, when somebody fails to achieve a score that results in a successful credit application the Board requires that the individual be given a specific reason for their failure.

An individual’s score can vary between 300 and 850 points. 660 points are typically seen as an important threshold when assessing a person’s creditworthiness. As each individual has three scores (one from each of the main reporting agencies) many lenders will check each score to establish an average.

Improving Your Credit

Your credit score can be improved if you:

- Always pay your bills on time

- Have at least 3-6 open and active credit accounts

- Have 1-2 loans

- Keep your credit card balances low

- Keep your accounts open for a long time

- Have a stable record of credit use

- Avoid too many applications for new credit

However, your credit score will decrease if you are late paying bills. Have either too many or too few accounts or max out your credit cards. Your score is also affected if you have a short credit record or make a large number of credit account applications.

RELATED: 23 Credit Score Dont’s and Do’s

How to Improve Credit Score Fast & Easy (3 Tips)

Whether you are trying to improve your credit or are looking for better opportunities in the future, there are three quick and easy things you can do to increase your credit score. If you have had some trouble with credit in the past you might feel like rebuilding a solid credit history will be a daunting task. While it will take some time to prove you are a consistently responsible consumer, there are a few simple things that you can do to help boost your score now, which will definitely pay off down the road. Of course, if you are not currently dealing with any kind of past credit issue, you can use this strategy to help you get ahead in the credit game.

1. Pay off or Pay Down Your Credit Cards

First of all, if you want to improve your credit score you can set a goal to pay off, or at least pay down significantly, one or more of your credit cards. This is, essentially, the only way that you have complete control over your credit score. Reducing your liability will inevitably influence your credit score. A single increase in the payment on one of your credit cards, then, will produce immediate results.

While the change may not seem significant in the beginning you will quickly find that this option is very simple and can be performed regularly or sporadically and as often as you like and will always help you. Obviously, this is a strategy that only works if you make the payment and then refrain from using the card (which would offset the improved payment that you made in the first place).

2. Check Your Credit Report

Another simple thing that you can do to help increase your credit score in a short amount of time is to actually check your credit report. The recent credit card reformation that saw so many new laws and regulations pass actually provides every consumer in the United States one free peek at their credit report every single year. This is not just so you can see where you stand in the financial industry but it is so you can make sure that all of the information is correct.

Credit report errors are actually more common than most people think and a single error on your credit report could mean the difference between approval and denial and between a 30 percent interest rate and one below 10 percent. Dispute any errors and have them fixed and repaired your credit as soon as possible.

The other reason why it is important to check your credit report is that you may not realize who has been trying to acquire your credit score. The more hard inquiries you have on your credit history, the more negatively it will affect your credit score. Of course, this will hurt you in the long run so be diligent about the information on your credit report.

3. Make Plan for Responsible Credit Management

Finally, if you really want to improve your credit score in a short amount of time then you need to formulate a plan for responsible credit management. This does not necessarily mean that you have to pay everything off as quickly as possible (though you should work out if and how that will be possible).

Instead, you need to be able, at the very least, to make your payments on time. A single missed payment can reduce your credit score by 100 points or more. On the other side of that, though, by simply getting back on track and continuing to make your payments on time you will be able to undo any damage that this might have caused. Furthermore, consistently steady payments will also improve upon any errors or missteps of your past.

Busting 7 Credit Myths

In some recently published advice, consumers are being encouraged to stay back from bad money advice thanks to some useful tips to bust the seven most common consumer credit myths. When it comes to credit scores and finances, myths can cause some huge problems. It is increasingly common for consumers to be faced with plummeting credit scores because they believed in some incorrect advice.

This can result in the consumer being unable to qualify for preferential rates when they apply for mortgages, credit cards or vehicle financing. The following seven myths are believed to be the most common misconceptions which can cause a downward credit spiral.

- My credit will be good as long as I make my minimum payments on time. In reality, even if you are making payments on time, those larger outstanding balances can drag your credit score down.

- Once I pay off a debt it will be taken off of my credit report. Again this is not true, while the debt will be reported as a closed or paid account, it still leaves a negative mark in your credit history.

- Errors involving amounts owed or paid off are the only ones that will affect my credit score. The truth is that any type of financial discrepancy however basic can have some bearing on your credit score.

- I can save money with zero percent deals. These sound good in theory, but unless you are highly organized and ensure that your balance is paid in full before the end of the zero percent offer, then you may be hit with unwelcome charges.

- Only strangers will steal my identity. The sad truth is that many identity theft cases actually involve a friend or relative who has easy access to your personal details.

- Online banking and shopping is not secure. This can depend on the bank itself and the retailers. Most will have very extensive security protection in place.

- A debit card is as safe to use as my credit card. Unfortunately, this is not the case. Prepaid and debit cards are not extended the same levels of fraud protection and liability insurance that credit cards are.

These are the most common 7 credit myths which consumers put their faith in on a regular basis. However, by doing so they could be burdening themselves with a questionable credit history. When it comes to advising about credit and finances it is always best to ask the experts rather than just go with what you hear from friends and co-workers.

Pumping Up Your Credit Score (10 Hints)

There are a few things you can do to repair your credit score. Enjoy the following list of suggested options:

- Pay your bills on time. You can make this easier by using automatic payments or have an automatic reminder on your computer. I pay my bills using on-line banking and as a free perk, I am reminded when the phone bill (and all other payments) is due.

- Pay off small balances right away and whittle at larger balances. Not only does it look good on your credit, but you are also more likely to get a mortgage or car loan if you need one. Emotionally speaking, you will love to see credit card debt shrink when you review your bill each month.

- Close account? Maybe. According to Craig Watts, an executive with one of the leading credit scorers: “Closing accounts can never help your score, and often it can hurt.” At one time, the accepted truism was to close unwanted accounts. Perhaps, we need to rethink that.

- Review your record with the major credit bureaus. Mistakes happen and they could happen to your account. If you find an error, correct it. If you find a small balance that is harming your credit pay it. You can get one free credit report from each bureau once a year. (See Card Reporting Credit)

- Have At least 3 open accounts. Some financial advisers suggest having at least three open accounts which are paid faithfully each month. Again, technology and automatic payments can help you with this pesky chore.

- Never be late. Yes, things happen. However, never be over 30 days late. That is the magic number that sends a negative report winging its way directly to your credit bureau. Very bad news!

- Too good to be true – Skip. Beware! There is no easy, pain-free way out of debt and into good credit. It is even less likely than the magic bullet that allows us to eat whatever we want and lose weight. Yeah, right! Don’t believe the scams.

- Don’t buy if you cannot afford it. Most of the time, if you cannot afford to pay cash – don’t buy it (whatever it is). Keep your credit balances small. Rule of thumb, buy items on credit that last over time (i.e, furniture, television, car).

- Avoid inquires to the credit bureau about your credit. Seriously consider your options before opening unneeded new accounts (even if you get 20% off on merchandise that day).

- Talk to your creditors. If you must be late due to unforeseen circumstances call your creditor. Explain your tardy payment and make arrangements until you can pay in a timely manner again.

7 Tips to Protect Your Credit Score When Unemployed

In the recent unsteady financial climate, losing your job is worse than ever. However, a new report issued outlines how to minimize the amount of damage that unemployed status can do to your credit history. When your sole focus becomes searching for jobs, attending interviews, and reworking your resume, it can be easy to forget about looking after your credit rating. However, by making a little effort and protecting your credit rating when unemployed, you can improve your chances of getting a job and once you have a regular income again it will be easier to get yourself back on track. The report offered seven tips to protect your credit rating if you are unemployed or feel that your job is no longer secure.

- Consider Payment Protection: This is a type of insurance that for a small monthly fee will put your payments on hold in the event of a job loss and is offered on credit cards, loans, and mortgages.

- Request A Credit Report: Even before sending out your resume, you should order copies of your credit report from the three major credit bureaus. This will allow you to find any issues and errors and work on fixing them. (See Credit Reporting Cards Explained)

- Stick To Cash: You may be tempted to charge a new ‘interview outfit’ or a few extra groceries and pay them off later. However, it is better to stick to cash and leave credit for real emergencies.

- Meet The Minimum: If you do not have a regular income, do not worry about paying down credit card balances just yet. Focus on meeting the minimum payments on time and keep cash reserves. Even a single late payment can reduce your credit score by 100 points.

- Communicate With Creditors: If you struggle to meet your payments do not ignore them. Contact your creditors and explain. They will be more inclined to work with you to set up a repayment plan if you are upfront about it.

- Defer Debts: Debts such as student loans are easily deferred during unemployment. You can request an “economic hardship” deferment allowing payments to be postponed. Deferment has no negative effect on credit scores as it is not reported as missed or late.

- Stop Applying For Credit: When unemployed it can be tempting to apply for a new line of credit for emergencies. However, the chance of approval is low when you are unemployed and multiple applications are detrimental to your credit score.

For more information check these articles: 9 Things to know about credit score, Soft vs Hard inquiries.