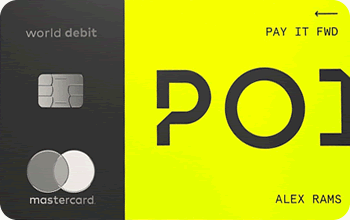

Point Debit Card World Mastercard®

Attractive benefits and high rewards without the downsides of a credit card

Updated: Jan 2, 2024

Point is a World Mastercard debit card and a Point app that brings you all benefits and rewards of a credit card but has no interest and no debt. It is an innovative way to earn up to 5 points per dollar and enjoy such benefits as phone insurance, no international transaction fee, car rental insurance, zero liability coverage, and much more. Apply today and earn 500 points right away!

ANNUAL FEE

$0

ONGOING APR

0% Fixed

INTRO APR

N/A

at Point App's Secured website

Apply NowApplication Fee

$0

Credit Reporting

No

Recommended Credit Score

Accepts All

Key Features

- Point Card and Point App. All benefits zero debt.

- Earn 500 bonus points - sign up and use the Point card, today!

- Earn 5x points on subscriptions (Netflix, Spotify, and more)

- Earn 3x points on food delivery and rideshare (DoorDash and Instacart, as well as taking a ride with Uber, Lyft, and Lime)

- Earn 1x points on everything else

- No international travel fees

- 2 free ATM withdrawals per month

- Unlimited quick bank transfers

- Virtual Point Card number

- 4 card designs: Runway Yellow, Dam Orange, Boulder Blush, Copper Canyon

- Point Card is issued by LCB, Member FDIC

Our Take

The Point is a Point Debit card and a Point App that works together in tandem. Point Card is the simple and transparent World Mastercard that earns you rewards and has many attractive benefits. Point App is an online banking app that helps you manage the debit card and your overall personal finances. The card is issued by LCB. It has 4 different designs, no foreign transaction fees, up to 5x points per dollar spent, bonus rewards, and premium additional benefits.

RELATED: What is a Point Debit Card?

What are Point Debit Card Benefits?

- Point tandem. The Point comes as a World Debit Mastercard and Point App.

- Bonus points. You will receive 500 bonus reward points instantly after activating your account and submitting an initial deposit.

- 5x, 3x 1x rewards. The Point account holders can earn 5 points per dollar for subscriptions ( Netflix, Hulu, HBO Max, YouTube Premium, Spotify, Pandora, Feather, and Headspace), 3 points per dollar for food delivery and rideshare services (DoorDash, Postmates, Caviar, Uber Eats, GrubHub, Seamless, Instacart, Good Eggs, Uber, Lyft, and Lime) and 1 point per dollar spend for everything else.

- No international transaction fees. The Point World Mastercard has no foreign transaction fees and is a great card to use when traveling.

- 4 editions. The POint Card comes in 4 editions – 01 Runway Yellow, 02 Dam Orange, 03 Boulder Blush, and 04 Copper Canyon.

Also, check Point Debit Card Review

Are there any Drawbacks?

- Membership fee. There is a small annual membership fee of $49. It will be charged from your initial deposit.

- Different approval levels. There are 3 approval levels – New, Normal, and Power. Each approval level has different limitations.

List of Additional Benefits

- Phone insurance

- New purchase insurance

- Trip cancellation insurance

- Global travel assistance

- Car rental insurance

- Zero liability coverage

- Deposit insurance

- 2 free ATM withdrawals per month

- Unlimited quick bank transfers

Point Debit Card Alternatives

| Issuer: | LendingClub Bank |

|---|---|

| Network: | Mastercard® |

| Category: | Consumer (Stored Value) |

| Review: | Full Card Review |

| Best Used For: |

|

| Rewards: | Yes |

| Reward Types: |

|

| Reward Units: | Point |

| Regular APR: | 0% |

|---|---|

| Regular APR Type: | Fixed |

| Annual Fee: | $0 |

| Balance Transfer: | No |

| Grace Period: | See Terms |

| Late Payment Fee: | See Terms |

| Other Fees: |

|

Point Debit Card World Mastercard® Alternatives

Point Debit Card World Mastercard® |

| APPLY NOW |

|

Annual Fee $0 |

|

Regular APR 0% |

|

Intro APR N/A |

|

Rec. Credit Score Accepts All |

Point Debit Card World Mastercard®

ReviewsSave to Compare